In a move that promises to reshape the Indian media landscape, entertainment giants Walt Disney and Reliance Industries Ltd. (RIL) are in advanced talks to merge their Indian media operations. The proposed deal, if finalized, would see Reliance hold a controlling 51% stake in the combined entity, with Disney retaining the remaining 49%.

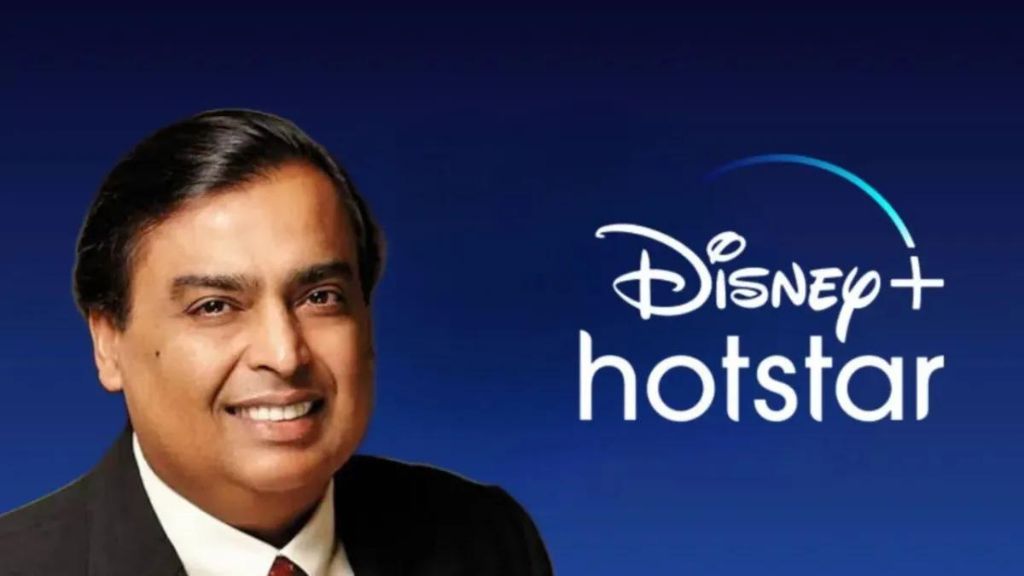

This strategic partnership, still under negotiation, aims to create a media powerhouse capable of dominating the Indian market. Reliance, led by billionaire industrialist Mukesh Ambani, already possesses a strong foothold through its Viacom18 subsidiary, which houses popular channels like Colors TV and JioCinema. Disney, on the other hand, boasts a loyal audience with its Disney+ Hotstar streaming service and beloved film and television franchises.

Key Drivers of the Merger:

- Market Consolidation: The Indian media market is witnessing rapid consolidation, with players vying for audience share in the face of fierce competition from global streaming giants like Netflix and Amazon Prime Video. This merger would allow Reliance and Disney to combine their resources and content libraries, creating a formidable competitor.

- Streaming Supremacy: Disney+ Hotstar currently enjoys a dominant position in the Indian streaming market, but faces growing challenges from JioCinema and other regional players. By joining forces, both companies could leverage their strengths to further solidify their lead in the digital space.

- Content Synergy: Merging Disney’s global content expertise with Reliance’s deep understanding of local preferences could lead to the creation of high-quality, diverse content catering to a wider Indian audience. This could range from Bollywood blockbusters to regional language programs and original series.

Challenges and Uncertainties:

- Regulatory Hurdles: The merger will require approval from Indian regulatory authorities, which may raise concerns about market dominance and potential anti-competitive practices. Navigating these regulatory hurdles could delay the deal or necessitate certain modifications.

- Cultural Integration: Blending the corporate cultures of two such large and diverse companies can be a complex and challenging task. Ensuring smooth integration and employee morale will be crucial for the success of the merged entity.

- Content Ownership: The ownership and distribution rights of existing content libraries need to be carefully addressed. Determining how to leverage both companies’ intellectual property while respecting regional sensitivities will be essential.

The Road Ahead:

While the final details of the merger are still being ironed out, the potential implications are significant. If successful, this deal could reshape the Indian media landscape, creating a dominant player with the resources and reach to reshape content creation, distribution, and audience engagement. However, navigating regulatory hurdles, integrating diverse cultures, and ensuring fair content ownership will be critical challenges that need to be addressed for the merger to truly bear fruit.

This landmark development is sure to be closely watched by industry experts, investors, and media enthusiasts alike. As the story unfolds, it will be fascinating to see how this strategic partnership ultimately impacts the Indian media landscape and shapes the entertainment choices of millions of viewers.