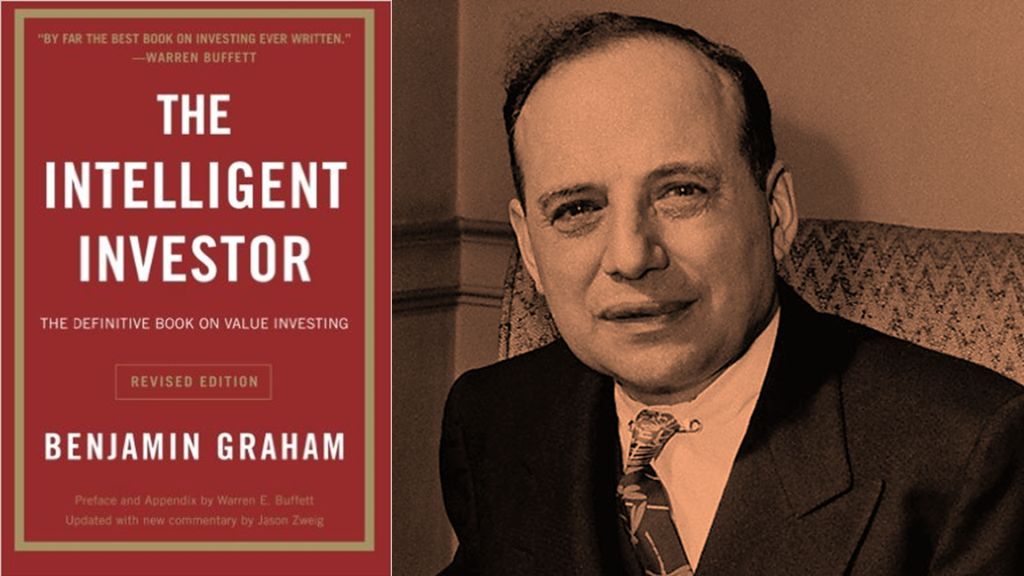

The stock market, oh the grand circus of emotions and numbers! It beckons with promises of wealth and freedom, but whispers tales of fear and loss. So, where does one navigate this exhilarating labyrinth? Enter Benjamin Graham, the father of value investing, and his timeless masterpiece, The Intelligent Investor.

Mr. Market, the Whimsical Auctioneer: Graham introduces us to “Mr. Market,” a manic-depressive fellow who fluctuates the prices of stocks based on his fickle moods, offering bargains one day and demanding ransoms the next. The intelligent investor, unlike the “Mr. Market Gambler,” learns to capitalize on these swings, buying when Mr. Market throws tantrums and selling when he gets euphoric.

Bargain Hunting with a Margin of Safety: But how do you identify a true bargain amidst the frenzy? This is where the margin of safety comes in. It’s like buying a sturdy umbrella during sunshine, a buffer against Mr. Market’s inevitable downpours. You buy stocks only when their price is significantly below their true “intrinsic value” – think of it as the company’s hidden treasure chest of assets and potential.

Finding Mr. Wonderful: But not all companies are created equal. The intelligent investor seeks out Mr. Wonderful – companies with strong financials, consistent profits, and a stable moat (think competitive advantage) protecting them from market storms. It’s not about the hottest trends or the fastest growth, but about steady, reliable businesses that are built to last.

Unveiling the Company’s Story: To unearth Mr. Wonderful, you need to become a financial detective. The financial statements are your magnifying glass, revealing the company’s inner workings. Ratios like P/E and debt-to-equity become your secret code, whispering tales of profitability and stability. But remember, numbers are just a part of the story. Look beyond the balance sheet and understand the company’s business model, its competitive landscape, and its vision for the future.

Defensive or Enterprising? Choose Your Weapon: Now, it’s time to pick your poison (not literally, of course!). The defensive investor seeks safety above all else, building a portfolio of reliable, dividend-paying companies that weather market storms like seasoned sailors. The enterprising investor has a higher risk tolerance, seeking out undervalued gems with the potential for explosive growth. It’s a spectrum, and where you land depends on your personal risk appetite and financial goals.

Spreading Your Wings (Without Getting Clipped): Remember, even the most careful bird can get clipped by a rogue wind gust. That’s why diversification is your feathered armor. Spread your investments across different asset classes and industries, ensuring that one bad apple doesn’t spoil the whole bunch. Think of it like building a wall of bricks, each representing a different stock, strong and unyielding against market tremors.

Taming the Emotional Rollercoaster: Investing is not just about numbers, it’s a mental marathon. Fear and greed, those two mischievous gremlins, can hijack your decisions and lead you astray. The intelligent investor learns to keep these emotions in check. Discipline and patience are your trusty steeds, guiding you through market peaks and valleys with a steady hand.

Mr. Graham’s Legacy: Invest for the Long Haul: The Intelligent Investor is not a get-rich-quick scheme, but a blueprint for building long-term wealth. It’s about understanding the true nature of stocks, analyzing companies with a critical eye, and staying the course through thick and thin. It’s about becoming an independent thinker, not a sheep blindly following the herd.

Becoming the Intelligent Investor: The path to becoming an intelligent investor is paved with knowledge, patience, and discipline. It’s a continuous learning journey, fueled by curiosity and a thirst for financial literacy. Read, analyze, question, and never stop educating yourself. Remember, Mr. Market will always be there, throwing tantrums and offering bargains. But with The Intelligent Investor as your guide, you’ll be ready to navigate the market maze with confidence, turning his volatile dance into a symphony of wealth creation.